WHAT IS PRE-QUAL?

With Pre-Qual, patients can find out instantly if they may be approved and for how much with no impact to their credit!*

While the Alphaeon Credit Card is known for strong approval rates and superior credit limits, some patients hesitate to apply because they don’t believe they will be approved or receive a credit limit high enough to cover the full cost of their care. Others are concerned about the inquiry hurting their credit score.

Pre-Qual can reduce those concerns.

*Not a final credit decision.

Credit card offers are subject to credit approval.

Alphaeon Credit Card Accounts are issued by Comenity Capital Bank.

HOW DOES IT WORK?

By providing just their name, address, social security number, and income, your patients can find out if they pre-qualify for an Alphaeon Credit Card.

With Pre-Qual, there is no hard inquiry or hit to the patient’s credit until they decide to complete a full application.

This is a fantastic solution for patients who hesitate to apply because they are worried about their eligibility or impacting their credit.

To pre-qualify, patients can either visit goalphaeon.com/apply or scan a QR code.

Select the Method That Works Best for Your Patients and Practice

PRE-QUAL TOOLS

Did you know that patients who apply for financing before their appointment are more likely to show up for their appointment and book their procedure, treatment, or service at the time of their appointment?

To educate patients before they arrive at your practice, be sure to:

Check your website’s financing page to make sure you are using the most recent Alphaeon Credit banner/logo that mentions Pre-Qual. If not, download the Alphaeon Credit Website Banner and upload it to your website.

Add information about Pre-Qual to your on-hold messaging using this Sample Copy.

Email or text patients before their initial appointment or while they are waiting in their cars to let them know about Pre-Qual. You can use this Sample Copy.

Remind patients about Pre-Qual while they are in your practice using these Flyers.

Announce Pre-Qual on your social media pages using these sample images and copy or by creating your own.

PRE-QUAL FAQS

Q. Is Pre-Qual* the same as pre-approval or QuickScreen offered by other companies?

A. It's not. Pre-approval or QuickScreen only asks for the patient's name and address. A patient may not be pre-approved with pre-approval, but they could be approved when a full application including the patient's social security number is submitted. Practices have reported that this process is inefficient, as information may need to be submitted twice.

Alphaeon Credit’s Pre-Qual is different. Pre-Qual asks for the patient's name, address, social security number, and income. With Pre-Qual, if the patient is not pre-qualified, they won't be approved if they submit a full application, so there is no need to submit the information a second time.

Q. Will Pre-Qual impact my patient's credit score?

A. No. There is no hard inquiry or hit to the patient's credit with Pre-Qual until they decide to move forward with a full application.

Q. What information does Pre-Qual require?

A. Only the patient's name, social security number, address, and income.

Q. Should patients include total household income?

A. According to the Card Act, credit card applicants can “include income or assets to which a consumer has a reasonable expectation of access.”

Q. My patient isn't ready to move forward with a full application. Can they save their pre-qualification?

A. No. If the patient is not ready to complete the full application, they can leave and return to pre-qualify again at a later time or date with no penalty. There is no limit to the number of times a patient pre-qualifies. However, if the patient's credit or income changes substantially since the last time they pre-qualified, there is a chance they may not pre-qualify again.

Q. Can I pre-qualify patients myself?

A. No. Patients must submit the information independently by visiting www.goalphaeon.com/apply, scanning the QR code on your table tents, or texting BEST to 97788. Remember, patients should not be connected to your practice or public Wi-Fi when they pre-qualify or apply independently.

Q. Why can't the patient apply when connected to our Wi-Fi or a public Wi-Fi?

A. When a patient applies on their own, there is no ID verification process. As a result, the bank uses additional fraud prevention measures, including limiting the number of applications that originate from the same IP address. As a result, the bank will automatically decline these applications.

Q. My patient pre-qualified; what's next?

A. To accept the offer and proceed to the full application, they must select "Continue" at the bottom of the "Congratulations" page. The next page will prompt the patient for their email address, and phone number and ask them to review the terms and conditions. After they do so, they select "Submit" to complete their full application. A full application can impact their credit score as it is considered a hard hit or hard inquiry.

Q. Can a patient pre-qualify but not be instantly approved when they submit the full application?

A. Yes. Because the information used for pre-qualification is only a sampling of an applicant's credit profile, it is possible that the data pulled for a full application impacted some of the parameters used when a full application is approved. However, more commonly, the applicant simply needs to provide some additional information. If a patient pre-qualifies, but isn’t instantly approved, please ask them to call the Account Protection Team at (800) 888-1726. They may also receive a call directly from this team.

Q. My patient was pre-qualified for a $5,000 credit limit but needs $7,000. Can they get a credit limit increase?

A. Possibly. After completing the full application, they can call (855) 497-8176 to request a credit limit increase. However, not all patients will be eligible.

Q. I prefer to apply for patients in my practice. Can I still do that?

A. Absolutely. Non-California practices can still apply for patients by logging into the Comenity Business Center. To address cost concerns upfront and save time during appointments, you may consider asking patients interested in financing to pre-qualify before their first visit by telling them, “If you’re interested in financing, you can find out if you are likely to be approved* and for how much without impacting your credit score by visiting www.goalphaeon.com/apply. If you do pre-qualify, do not complete the full application by selecting “Continue” and let us know at your appointment and we will complete a full application at that time.” At their first visit, you can complete a full application for those that pre-qualified, and for those that didn’t pre-qualify, you can discuss other payment options.

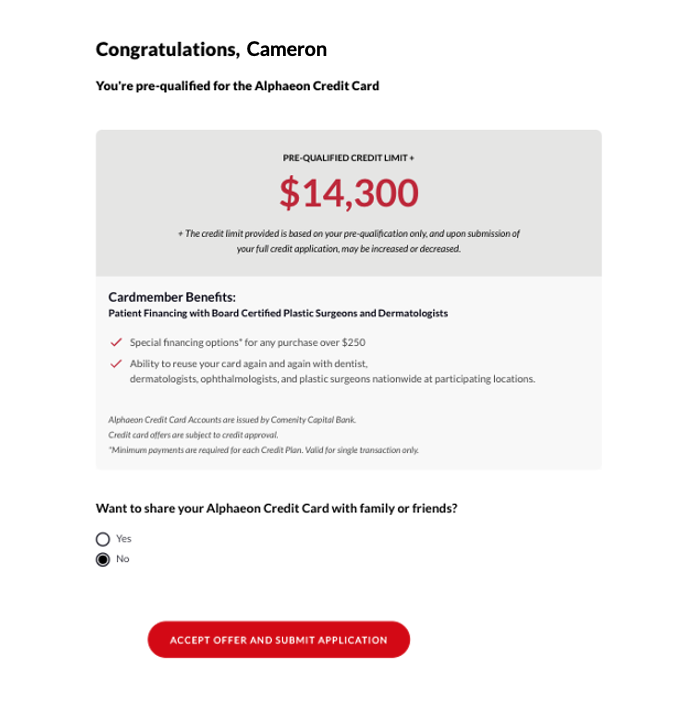

Q. What does the screen look like if they pre-qualify?

A.

To accept the offer and proceed to the full application, they must select "Continue" at the bottom of the "Congratulations" page. The next page will prompt the patient for their email address, and phone number and ask them to review the terms and conditions. After they do so, they select "Submit" to complete their full application. A full application can impact their credit score as it is considered a hard hit or hard inquiry.

Q. What does the screen look like if they don’t pre-qualify?

A.

Please note, an applicant who does not pre-qualify will not be approved if they complete the full application by selecting “apply for the Alphaeon Credit Card.”

Q. What does the screen look like if they pre-qualify, but aren’t instantly approved?

A.

If a patient pre-qualifies, but isn’t instantly approved, please ask them to call the Account Protection Team at (800) 888-1726. They may also receive a call directly from this team.

* Not a final credit offer.

Credit card offers are subject to credit approval.

Alphaeon Credit Card Accounts are issued by Comenity Capital Bank