Debunked! The Persistent Myths About Patient Financing

For over a decade, Alphaeon Patient Financing has worked to address the tensions that arise between two delicate issues: the care patients need and how they are going to pay for it.

For over a decade, Alphaeon Patient Financing has worked to address the tensions that arise between two delicate issues: the care patients need and how they are going to pay for it.

Most practices certainly don’t need a headline to tell them the obvious: patients are more financially stretched than ever, and elective medical care is colliding with households running on thinner margins. As of 2025, over two-thirds of Americans (67%) are living paycheck to paycheck, up from about 63% in 2024, according to PNC Bank’s Financial Wellness in the Workplace Report.

Yet despite these numbers, patients and practices often have misunderstandings about patient financing - both what it is and how it works. Patient financing myths and healthcare financing misconceptions abound and can keep patients from accessing care.

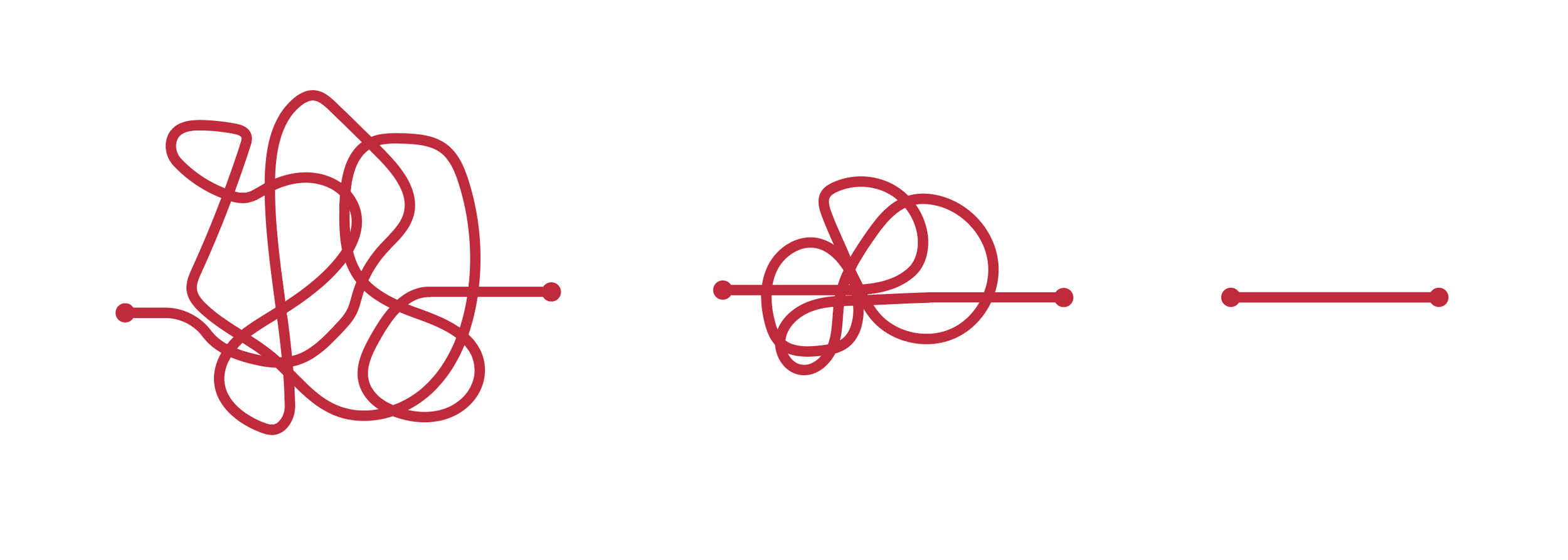

Some see patient financing as a last resort for “risky” patients. Others worry it will damage credit scores, or assume offering financing will make the practice seem pushy or sales-driven. These claims don’t just cloud decision-making; they can quietly block patients from accessing care they want and need.

In the last decade, we’ve answered these questions so many times that they’re no longer just misconceptions: they’ve become elaborate myths. Like the history of the Trojan War, they’ve been passed on by tradition and now form the basis of how patients and practices understand their situation.

While archaeologists may have found the fallen city of Troy, there’s a lot less fact to most of the things patients and practices say about financing. Happily, most of these myths are either misrepresentations or entirely false.

In this article, we’d like to quickly and plainly slay some of these common patient financing myths for providers. We’ll explain and disambiguate any shred of truth behind them and leave you with a new understanding of how patient financing can be used as your practice’s secret tool to help you help more patients and strengthen your patient communication with the best practices for financing.

Myth #1

Patient Financing is only for people with bad credit or who can’t afford the care.

Rating: FALSE!

Many elective healthcare providers believe that offering patient financing means catering only to patients who have subpar credit or who are financially desperate. This is simply not accurate. Assuming it is can lead practices to miss out on a significant portion of patients who can afford care, but prefer flexible payment options.

Alphaeon Patient Financing is built intentionally to cater to a broad spectrum of credit profiles and budgets, offering multiple financing options from prime to subprime in one application.

Remember, only 40% of Americans say they could afford a surprise $1000 expense. For many patients, financing may be the difference between saying “Yes, now!” and “Maybe, later…”

And even high and middle-income households may prefer to spread payments rather than pay a lump sum upfront. For those eligible for “no-interest if paid in full” options, financing just makes sense! It allows patient to hold onto their cash during uncertain economic times.

In short, financing is not an indicator that a patient is “risky,” or that they can’t afford your practice’s care. (That’s a persistent healthcare financing misconception.) Patient financing is a tool that gives patients a choice, and it’s a path for them to access the care they need now.

Myth #2

Applying for financing will hurt a patient's credit score.

Rating: ALMOST ENTIRELY FALSE!

This is one of the most persistent patient financing myths and one that often stops patients from even exploring their options. Many assume that any application for credit automatically damages their score. In reality, any impact, when and if it occurs, is minor, temporary, and conditional.

At Alphaeon Credit, prequalification is a soft credit inquiry. A “soft hit” has zero impact on a patient’s credit score. It’s visible only to the consumer and not to other lenders. This is why prequalification is a no-risk step, an important point to make when talking to patients about financing! With soft-hit prequalification, patients can see whether they are likely to be approved and for how much without impacting their credit score in any way.

A hard inquiry, used only during the final application, may cause a small, temporary dip of a few points. Even then, the effect typically fades within a few months. Independent research backs this up. According to Experian, a single hard inquiry generally lowers a credit score by less than five points, and “for many people, the change is so small that it doesn’t impact their ability to qualify for credit”. Experian also notes that inquiries count for only 10% of the FICO score calculation — a relatively minor factor compared to payment history and credit utilization.

Most importantly, the inquiry itself is not what meaningfully shapes a credit score — the account that’s opened afterward is what really matters. Responsible use, like making on-time payments, can actually improve a patient’s credit history over time.

So, patients who want to improve their credit scores, take note: the best way is to take out reasonable financing and make on-time, regular payments. Doing so will improve credit scores and make future financing even easier to obtain.

Myth #3

Offering financing is complicated, risky, and a regulatory headache.

Rating: FALSE!

Some practices hesitate to offer patient financing because they imagine it will add administrative burden, create compliance risk, or require staff to become mini-loan officers. In reality, modern patient-financing platforms, especially Alphaeon Patient Financing, are built to eliminate friction so practices can focus on care, and not on paperwork.

The idea that offering financing is “complicated” often comes from outdated experiences with legacy credit providers. But with Alphaeon Credit, the process is intentionally streamlined: simple digital applications, fast decisions, and no need for your staff to manage approvals, payments, collections, or compliance steps. The entire financial relationship stays between the patient and Alphaeon, not the practice.

And when questions do arise, practices aren’t left to their own devices. Alphaeon’s Practice Support Hotline is staffed 24/7 by Alphaeon employees who help teams with processing applications, answering product questions, scheduling staff training on payment plans, and offering patient financing best practices in real time. Whether you need to schedule a training for new front desk staff or clarify a financing scenario, your team can get answers immediately, no phone trees, no lost emails, no guesswork.

Myth #4

Patients don’t trust a practice if they offer financing.

Rating: NOT ONLY WRONG, BUT THE OPPOSITE!

When a patient sees that an external financing partner has approved them, three things happen:

Validation — The patient interprets the approval as evidence they can move ahead, which shifts the conversation from “Can I afford this?” to “How do we proceed?”

Confidence — Because the financing comes via a third-party, the patient views the offer as objective rather than practice-driven, reducing perceptions of upselling.

Activation — When payment options are clear and pre-approved, patients are more likely to schedule or begin treatment.

Offering patient financing isn’t a liability; it can actually help patients overcome objections.

Financing through a reputable third-party also strengthens the patient’s trust. For example, the Consumer Financial Protection Bureau has studied medical-credit products and warns of practices that sidestep protections; when a practice partners with a regulated lender, the patient benefits from transparency, clear disclosures, and external oversight. The Alphaeon Credit Card is backed by Comenity Bank, which serves 50 million customers and is the issuing bank for dozens of popular brands like Ann Taylor, Express, AAA, Lane Bryant, and Ulta Beauty.

This is why we recommend that patients be encouraged to prequalify for financing regardless of their situation. A third-party approval gives a patient the confidence to move forward with the care they need and the care your doctors prescribe.

Myth #5

Patient Financing doesn’t matter. Patients either move forward or they don’t.

Rating: FALSE AND COSTLY!

This belief is common—but it’s also one of the most costly. Many practices assume that patients make a simple yes/no decision based only on the desire for care. In reality, a large percentage of patients fall into a third category: they want the treatment, they trust the provider, but the upfront cost feels difficult.

According to a recent Bankrate survey, 73% of Americans say they’re saving less for unexpected expenses than they were a year ago. This means many households simply don’t have the liquidity to absorb a significant cost.

However, when patients see clear, predictable monthly payments (especially after a painless soft-hit prequalification), the decision becomes manageable rather than overwhelming. Instead of walking away or delaying care, patients can confidently move forward.

For practices, financing has a measurable impact: higher case acceptance, larger average treatment value, and fewer postponed or incomplete procedures. And because Alphaeon Patient Financing handles underwriting, servicing, compliance, and collections, the practice benefits without operational strain. Helping patients understand affordable monthly options is central to learning how to talk to patients about financing and improving treatment acceptance.

Across all five myths, a clear pattern emerges: patients aren’t avoiding care—they’re avoiding uncertainty. They want clarity, options, transparency, and a sense of partnership. Alphaeon Patient Financing, with soft-hit prequalification, strong approval rates, and dedicated practice support, gives patients exactly that.

By normalizing financing conversations and implementing patient communication best practices, your team can remove barriers, increase trust, and help more patients say “yes” to the care they’ve been hoping for.

Alphaeon webinar - “The Empathy Engine: How Emotionally Intelligent Leadership Fuels Revenue Growth in 2026”

In a rapidly evolving dental landscape, emotional intelligence has become one of the most powerful—and underrated—drivers of practice performance. This course explores how empathy-centered leadership elevates patient trust, strengthens team alignment, and directly improves case acceptance and revenue outcomes. Drawing from over a decade of pediatric experience, I’ll share practical communication frameworks that reduce friction in treatment and financial discussions, empower staff to operate with confidence, and enhance the overall patient experience. Attendees will leave equipped with actionable strategies to integrate emotional intelligence into their leadership style, team culture, and business planning as they prepare for growth in 2026 and beyond.

Join us Friday, December 19, 10AM EST, 7AM PST for this free virtual event!

Presented by Dr. Trudy-Ann Frazer

Pediatric Dentist and Industry Leader, Creator of the “Not Just A…Dentist” Podcast

In a rapidly evolving dental landscape, emotional intelligence has become one of the most powerful—and underrated—drivers of practice performance. This course explores how empathy-centered leadership elevates patient trust, strengthens team alignment, and directly improves case acceptance and revenue outcomes. Drawing from over a decade of pediatric experience, I’ll share practical communication frameworks that reduce friction in treatment and financial discussions, empower staff to operate with confidence, and enhance the overall patient experience. Attendees will leave equipped with actionable strategies to integrate emotional intelligence into their leadership style, team culture, and business planning as they prepare for growth in 2026 and beyond.

Course Description

By the end of this course, participants will be able to:

Explain the connection between emotional intelligence, patient decision-making, and increased case acceptance across dental specialties

Identify communication strategies that reduce patient hesitancy around treatment recommendations and financial discussions

Apply empathy-based leadership principles to improve staff alignment, accountability, and overall team performance

Evaluate key operational behaviors that influence revenue growth and implement systems that support consistent patient experiences

Develop an actionable 2026 growth framework that integrates emotional intelligence into leadership, team culture, and patient communication pathways

About Dr. Frazer

Dr. Trudy-Ann is a board-certified pediatric dentist originally from Lucea, Jamaica who practices in Atlanta, Georgia. She is an international speaker renowned for her skillful combination of chair-side dental care and educational leadership, particularly in teaching dental professionals how to treat children in the dental setting with ease, teaching dental professionals how to overcome burnout, and lecturing dental students in preparation for the National Dental Board Exam.

REGISTER NOW TO ATTEND

Alphaeon webinar - “The 2026 Dental Office Playbook: Revenue & Billing Systems That Actually Work”

Today’s dental practices are fighting a revenue battle on multiple fronts—rising claim delays, inconsistent billing workflows, overwhelmed teams, and unpredictable cash flow. Most offices know their systems could run smoother… but few have the clarity, structure, and alignment needed to make it happen.

In The 2026 Dental Office Playbook: Revenue & Billing Systems That Actually Work, Ashley Bond, Co-Founder & Chief Dental Billing Officer at Wisdom, breaks down the proven operational and billing frameworks that top-performing practices rely on to protect revenue, reduce friction, and support scalable growth.

Join us Tuesday, December 16, 1PM EST, 10AM PST for this free virtual event!

Presented by Ashley Bond

Co-Founder & Chief Dental Billing Officer at Wisdom

Today’s dental practices are fighting a revenue battle on multiple fronts—rising claim delays, inconsistent billing workflows, overwhelmed teams, and unpredictable cash flow. Most offices know their systems could run smoother… but few have the clarity, structure, and alignment needed to make it happen.

In The 2026 Dental Office Playbook: Revenue & Billing Systems That Actually Work, Ashley Bond, Co-Founder & Chief Dental Billing Officer at Wisdom, breaks down the proven operational and billing frameworks that top-performing practices rely on to protect revenue, reduce friction, and support scalable growth.

This session is designed for both emerging and established practices looking to streamline their operations, empower their teams, and finally take control of the revenue cycle. Whether you're a doctor, practice manager, front office leader, or billing specialist, you’ll walk away with practical steps you can implement immediately.

By the end of this webinar, attendees will be able to:

Identify operational and billing breakdowns that cause revenue loss in dental practices

Understand how to implement consistent revenue & billing systems without overwhelming their teams

Learn how to reduce insurance AR and claim delays while improving cash flow predictability

Align front office, clinical, and billing teams around a unified revenue workflow

Build scalable systems that reduce burnout and support sustainable growth

REGISTER NOW TO ATTEND

Alphaeon webinar - “Alphaeon Success Lab: Expert Guidance for Growing Patient Revenue”

Join us for an exclusive live virtual training event designed to help your practice get the most out of Alphaeon Patient Financing.

Join us Friday, December 12, 12PM EST, 9AM PST for this free virtual event!

Join us for an exclusive live virtual training event designed to help your practice get the most out of Alphaeon Patient Financing.

Whether you're new to the platform, need a quick refresher, or want to optimize your current processes, this webinar connects you directly with Alphaeon platform specialists who will walk you through high-impact tips, best practices, and live demonstrations.

Participants will also have the opportunity to ask questions, troubleshoot challenges, and learn how top practices use Alphaeon to increase approvals, improve patient experience, and drive higher revenue.

As part of our Alphaeon Usage Sweepstakes, attending the webinar and logging into your platform counts toward your sweepstakes entry—giving your practice an additional incentive while gaining valuable training that elevates your financial workflow.

REGISTER NOW TO ATTEND

Women in DSO® Welcomes Alphaeon Patient Financing as a Platinum Industry Partner, Appoints CMO Amy Mendoza to Advisory Board

Women in DSO® proudly announces Alphaeon Patient Financing as its newest Platinum Industry Partner, reinforcing a shared commitment to expanding access to care, supporting clinical and business innovation, and advancing women leaders across the dental and healthcare ecosystem.

Women in DSO® proudly announces Alphaeon Patient Financing as its newest Platinum Industry Partner, reinforcing a shared commitment to expanding access to care, supporting clinical and business innovation, and advancing women leaders across the dental and healthcare ecosystem.

As part of this partnership, Amy Mendoza, Chief Marketing Officer of Alphaeon Patient Financing, has been appointed to the Women in DSO Advisory Board, where she will collaborate with industry executives and stakeholders to drive meaningful impact for the DSO community and patient care.

Alphaeon Patient Financing empowers providers and practices with flexible payment solutions that remove cost barriers and help patients move forward with the health and wellness treatments they want and need. With a strategic focus on access, equity, and technology-forward innovation, Alphaeon’s mission aligns strongly with Women in DSO’s work to amplify leadership and transform outcomes across dentistry.

"We are thrilled to welcome Alphaeon Patient Financing into our Women in DSO partnership community,” said Dr. Aman Kaur, Founder and President of Women in DSO®. “Their focus on wellness, innovation, and expanding access to care for patients reflects the very heart of our mission. We look forward to the expertise and leadership that Amy Mendoza will bring to our Advisory Board as we continue to advance women in leadership throughout the DSO industry.”

Through this collaboration, both organizations will support programming, research, leadership development, and events — including the Women in DSO Wellness & Innovation Summit and the Empower and Grow Conference — designed to elevate female executives and emerging leaders in the profession.

About Alphaeon Patient Financing

Alphaeon is a leading healthcare finance company dedicated to helping patients afford care and providers grow their businesses. Based in Newport Beach, Calif., Alphaeon combines best-in-class provider support with innovative patient financial solutions. The company serves more than 10,000 providers across multiple healthcare specialties, offering low merchant fees, high credit limits and competitive interest rates, allowing providers to deliver needed care while enabling financial stability.

About Women in DSO®

Women in DSO® is the premier organization dedicated to supporting and empowering women in Dental Support Organizations and dental leadership. Through events, education, mentorship, and thought leadership, Women in DSO champions growth, representation, and influence for women across the global dental industry. Learn more at www.womenindso.org

About amy mendoza

Amy Mendoza, MBA is an award-winning marketing executive and innovative growth strategist with more than 20 years of experience transforming brands, scaling high-growth organizations, and accelerating market expansion across healthcare, dental, and technology sectors.

As Chief Marketing Officer for Alphaeon Patient Financing, Amy leads national brand strategy, digital transformation, and go-to-market initiatives designed to increase access to care and elevate the patient financial experience.

Amy’s leadership has been recognized across the industry, earning her a Merit Award for Marketing and Communications Excellence and inclusion on Becker’s Healthcare list of Top Women in Health IT—highlighting her impact in advancing innovation, digital transformation, and patient engagement in modern healthcare.

Previously, Amy served as Vice President of Marketing at Vyne, where she led a comprehensive brand evolution that helped position the organization as a 2024 Digital Health Hub Award Quarterfinalist for Dental Innovation. Earlier in her career, she led marketing strategy for a national dental marketing agency supporting more than 500 practices and DSOs across the U.S.

A founding board member of Women in DSO®, Amy is a recognized leader and mentor dedicated to advancing representation and leadership pathways for women in dentistry and healthcare. She is a frequent speaker at global conferences—including the ADA SmileCon, Empower & Grow, and leading healthcare, technology, and leadership forums—and is actively involved in supporting emerging talent through university mentorship and professional development programs.

Passionate about elevating brands and building high-performing teams, Amy brings a future-focused approach to marketing leadership—where innovation, purpose, and measurable business impact align.

2025 Halloween Costume Contest Winners!

We love seeing our practices shine both in and out of the office — and this year’s Halloween costume contest did not disappoint!

1ST PLACE

Hoffmann Family Dentistry

The Hoffmann team went all-in on creativity. Their dramatic looks, bold colors, and spot-on details earned top marks for creativity and commitment!

2ND PLACE

Ponte Vedra Plastic Surgery

The Founding Fathers never looked so fabulous! The Ponte Vedra crew gave history a modern twist with their picture-perfect period costumes — a revolutionary look that stole second place.

3RD PLACE

Habashy Dental Westlake

An ogre-the-top performance! The Habashy team brought the swamp to life with their Shrek-inspired looks — a fairy-tale transformation that was truly ogre-whelmingly good.

Congratulations to our winners, and thank you to everyone who joined the fun! We can’t wait to see your creative costumes next year.

Alphaeon ThanksGIVING

Our Way of Saying Thanks to You

A six-week celebration of our providers — and the patients they help every day.

As we head into the season of gratitude, we want to take a moment to thank the providers who make Alphaeon Patient Financing such a trusted part of your patient care.

To show our appreciation, we’re introducing Alphaeon ThanksGIVING — a six-week celebration recognizing the practices that continue to help patients move forward with the care they want most.

From November 4 through December 14, 2025, every Alphaeon Credit Card application and transaction gives your practice a chance to win eGift Cards worth up to $500 — just for doing what you already do best.

How It Works

Submit Alphaeon Credit Card Applications: 1 entry per application (regardless of approval status)

Process Alphaeon Credit Card Transactions: 1 entry per transaction

Entries are counted Monday through Sunday and reset at 12:00 a.m. PT each Monday, giving every practice a new opportunity to participate in that week’s drawing.

Weekly Prizes:

🥇 $500 Visa eGift Card

🥈 $300 Visa eGift Card

🥉 $150 Visa eGift Card

Winners will be announced by email each Monday, and prizes will be delivered electronically upon email confirmation.

Interested in learning more?

Join us for an exclusive live virtual training event designed to help your practice get the most out of Alphaeon Patient Financing on Friday, December 12, 2025, 12PM EST, 9AM PST,

Whether you're new to the platform, need a quick refresher, or want to optimize your current processes, this webinar connects you directly with Alphaeon platform specialists who will walk you through high-impact tips, best practices, and live demonstrations.

REGISTER FOR THE LIVE TRAINING NOW

Important Details

Promotion Period: November 4 – December 14, 2025

Eligible Participants: Enrolled Alphaeon Credit providers in the U.S.

Limit: One (1) prize per practice for the duration of the campaign

Entry Window: Entries are counted Monday through Sunday and reset each Monday at 12:00 a.m. PT

Winner Selection: Winners selected at random, weekly and announced by email each Monday

Prize Delivery: Prizes delivered electronically upon email confirmation

No purchase necessary. Void where prohibited.

(Full Terms & Conditions below.)

Thanks!

We’re grateful for every provider who partners with us to make patient financing easier, smarter, and more accessible.

An Alphaeon ThanksGIVING – Official Terms and Conditions

1. Promotion Period

The Alphaeon ThanksGIVING Promotion (“Promotion”) begins at 12:00 a.m. Pacific Time (PT) on Monday, November 4, 2025, and ends at 11:59 p.m. PT on Sunday, December 14, 2025 (“Promotion Period”).

Entries will be counted from Monday through Sunday each week, with winners announced the following Monday.

2. Eligibility

The Promotion is open only to enrolled Alphaeon Credit providers located in the United States who are in good standing during the Promotion Period. Practices affiliated with membership groups that do not utilize the Alphaeon Dashboard are not eligible to participate. Employees of Alphaeon, its affiliates, subsidiaries, advertising and promotion agencies, and their immediate family members are not eligible to participate.

3. How to Participate

Eligible providers will automatically receive entries based on Alphaeon Credit Card activity during the Promotion Period.

Entry Method 1: Receive one (1) entry for each Alphaeon Credit Card patient application submitted through the Alphaeon Dashboard. Applications count as entries regardless of approval status.

Entry Method 2: Receive one (1) entry for each Alphaeon Credit Card transaction processed through the Alphaeon Dashboard.

Entries are recorded automatically; no purchase is necessary to enter or win.

Entries from each week are counted from Monday at 12:00 a.m. Pacific Time (PT) through Sunday at 11:59 p.m. PT. After each weekly period closes, all entries reset at 12:00 a.m. PT on Monday, giving every practice a brand-new opportunity to earn entries for that week’s drawing.

4. Prizes

Each week, three (3) winners will be selected at random from eligible entries and awarded the following prizes:

Grand Prize: $500 Visa eGift Card

Second Prize: $300 Visa eGift Card

Third Prize: $150 Visa eGift Card

A total of 18 prizes will be awarded throughout the campaign period.

Total Approximate Retail Value (ARV): $5,700 (over 6 weeks).

Limit one (1) prize per practice for the duration of the Promotion.

5. Winner Selection and Notification

Winners will be selected at random from all eligible entries each week during the Promotion Period.

Each weekly entry period runs from Monday at 12:00 a.m. Pacific Time (PT) through Sunday at 11:59 p.m. PT. Winners for each week will be announced the following Monday (e.g., Week 1 winners announced Monday, November 10, 2025).

Winners will be contacted via the email address associated with their Alphaeon Credit account and asked to confirm their preferred email address for reward delivery. Once confirmation is received, eGift Cards will be fulfilled through Tremendous, a third-party digital reward platform, and sent directly to the confirmed email address.

If a winner does not confirm their email address within five (5) business days of notification, Alphaeon reserves the right to select an alternate winner.

6. General Conditions

No cash or prize substitutions are permitted except at Alphaeon’s sole discretion. Alphaeon reserves the right to verify eligibility, modify, suspend, or terminate the Promotion at any time. Taxes, if any, are the sole responsibility of each winner. Entries generated by fraud, technical failure, or unauthorized means will be void.

7. Privacy

Participant information is used solely to administer this Promotion and in accordance with Alphaeon’s Privacy Policy.

8. Additional Terms

Void where prohibited by law. By participating, providers agree to these Official Rules and to Alphaeon’s decisions, which are final and binding in all respects.

Simplify with Alphaeon Credit

Get More Time Back in Your Day

Like other practices across the country, you may be doing more with less these days. Staffing shortages and overbooked schedules have many assuming more responsibilities and with less time to accomplish them.

While Alphaeon Credit can't solve these particular issues, there are many ways that you can streamline the patient financing process to save time and get more hours back in your day.

1 - Reduce follow-up calls and emails attempting to schedule procedures or treatments by offering financing to all

Studies show that patients who have been informed about financing options or have financing secured at their initial appointment are more likely to schedule at their consultation. These patients don't need to "check with my spouse" or "think about it"; they are ready to move forward when there is no cost barrier.

Patients want to know about financing, but are often uncomfortable asking about it, and you can't read minds. If you can get in the habit of presenting financing to all patients versus only those who ask, you can help more patients move forward faster.

The conversation doesn't have to be difficult either: "The cost is X, and many of our patients take advantage of our financing options that allow you to pay over time." This way, not only have you informed them of your financing options, but by mentioning that "many patients take advantage of it," you have also destigmatized financing.

Remember that a recent Alphaeon Credit cardholder survey showed:

52% of patients don't know how they will pay for a procedure or treatment before their initial appointment

50% of patients are surprised to find out the cost was more than they anticipated

65% of patients would have delayed or not moved forward if financing wasn't available

With those numbers in mind, imagine what's going through your patients’ minds when they cancel or, even worse, ghost your practice. They may not have told you, but frequently, it's about their ability or willingness to pay.

Promoting patient financing and presenting it as a payment option alongside traditional credit cards and cash will allow more of your patients to move forward and schedule immediately, reducing or eliminating any follow-up calls and emails.

2 - Eliminate the financing conversation by encouraging patients to pre-qualify BEFORE their appointment

If patients pre-qualify before they come into your practice, you won't even have to discuss financing at their initial appointment, saving even more time.

The Alphaeon Credit cardholder survey showed that most patients learned about financing from someone at the practice. What if you could educate them before their initial appointment?

To begin, make sure financing options are prominent on your website. The second most popular page on most practice websites is the "financing" or "affordability" page. Since most new patients (and many existing) visit your website before scheduling an appointment, they may learn about their options and pre-qualify before their initial visit if you make financing highly visible.

You can download banners for your website here.

Every week, multiple patients reach out to Alphaeon Credit, asking specific practices to enroll. Sometimes those practices are already enrolled and the information just isn’t on their website’s financing page.

Also, encourage patients to apply before their appointment by texting or emailing a pre-qualification link with the patient's appointment reminder. If you are sending these appointment reminders through an automated system, add the following language to your message:

Click here to get these text messages as plain text to copy for your own use.

Do you send pre-appointment paperwork? This is another opportunity to have the patient learn about and secure financing before coming to your practice.

And while patients are in your office, display signs, table tents, and brochures with QR codes so patients can pre-qualify in your waiting room and exam lanes while they wait.

Click here to download printable QR code flyers.

Pre-qualification doesn't hurt a patient's credit score, so there's no reason not to encourage patients to find out if they are likely to be approved and their credit limit.

3 - Get Immediate Answers by Using Alphaeon Credit's Practice Hotline

Please don't spend more than a minute of your time figuring out any issues regarding Alphaeon Credit on your own. If something is unclear or you have a problem, simply pick up the phone and call the Alphaeon Credit Practice Hotline.

There are no phone trees, no call centers, just an Alphaeon Credit team member who will pick up the phone day or night, weekday or weekend.

Today, Alphaeon Credit answers 99% of calls with a live team member in the first 60 seconds, and on the rare occasion when a practice has to leave a message, rest assured that 100% of callers receive a call back, usually within a minute or two.

So anytime you have an issue, call (920) 306-1794, and someone will be ready to help immediately!

Joanne Miles, the Practice Facilitator at Kiene Dental, shared: "On the occasion when we have needed some phone support, they have been there with little to no hold time. They always get us the solutions we need, and they are so friendly!"

And coming soon...

Keep an eye on your email over the next month regarding some exciting new upgrades to our patient financing platform that may save you even more time!

As always, if you need absolutely anything or have any suggestions on how to improve Alphaeon Credit, please share them! Call our practice hotline at (920) 306-1794 or email teamcredit@alphaeon.com.

30 Ways to Avoid Resignations and Engage Your Team

Has ‘The Great Resignation’ affected your practice? If so, you’re not alone.

While patient demand rebounded from the heights of the COVID-19 pandemic, practices across the country have faced additional challenges as employees resigned or failed to return to work.

In addition, some of your team members may be looking for greener pastures. According to a recent Gallup analysis, nearly half of all US workers are actively looking for another job.

Aside from burnout, the most common reasons for leaving include a lack of appreciation, feeling connected to co-workers, advancement/training opportunities, and/or flexibility.

With this in mind, Alphaeon Credit has compiled a list of low-cost ideas successfully implemented by practices across the country to motivate, encourage, and keep your team happy and productive!

30 WAYS TO ENGAGE YOUR TEAM

Show Appreciation

- Send flowers to the office on a new employee's first day of work and/or on employees' work anniversaries.

- Handwrite thank-you notes to new employees on their one-month anniversary and/or current employees annually.

- If your employees are on LinkedIn, endorse them or write a recommendation.

- On social media (LinkedIn, Facebook, Instagram, TikTok), celebrate by announcing when new employees have joined your team and/or celebrate current employees’ anniversaries and/or birthdays. Social media automation tools, like Buffer or Later can make this easier.

- Always take time to greet your team members during the day no matter how hectic.

- Ask doctor(s) to attend team meetings to build more meaningful connections with the employees.

- Share patient testimonials during team meetings and post where employees can read them such as the break/lunchroom.

- Ask patients to write a review if a team member went “above and beyond”. To encourage participation, you can incentivize patients by holding a $100 raffle for those who participate. Once reviews are gathered, you can share them during team meetings and provide some type of small reward or token to acknowledge the praised employee(s).

- Ask employees to vote for employee of the week or month and reward the winner with a certificate and a gift.

- Pick up coffee and bagels for everyone occasionally on your way into the office.

- Provide quarterly perfect attendance awards with the prize of a 1/2 day off.

- Discuss and celebrate small milestones such as achieving weekly or monthly practice goals. Share your practice's monthly or quarterly goals with your team and if achieved, schedule an afternoon or day off each quarter (outside of their paid time off).

- After a year of employment, let team members choose a procedure, treatment, or service for free. Not only will these individuals be better equipped to speak about their experience with prospective patients, you can also have them review your process, from call to consult as a typical patient, to identify areas of improvement within your practice.

Create Community

- Have a “Friday Fun Day” with a trip to Top Golf, bowling, an escape room, karaoke, laser tag, arcade, or paintball.

- Host a “Because You Make Our Patients Feel Great Day” at a local spa with massages or treatments for your team.

- Treat the team to an afternoon at a sporting event like a baseball game - bonus points if you can make it a surprise and/or provide practice branded baseball caps.

- Get out of the office and into nature by taking your team to a beach, a lake, canoeing/kayaking, a cruise, horseback riding, skating, or even out on a hike.

- Celebrate holidays rarely celebrated like "Say Something Nice Day" or "Working Parents Day". See a list of more holidays here.

- Host a monthly team lunch outside of the practice.

- On a slow afternoon, bring in ice cream treats for your team or hire an ice cream truck to come to your location.

- Host a team dinner at a restaurant (or your home) and toast each employee individually and share why you appreciate them.

- Host a holiday party for your team and their significant others so you can get to know them outside of the practice.

- Celebrate birthdays by providing lunch for the team with the birthday employee selecting the restaurant.

- Celebrate personal milestones such as engagements, weddings, and any new additions to your employees' families (including those with fur).

Provide Advancement/Training Opportunities

- Provide timely and daily feedback on performance, such as "Great job converting that patient today!"

- Recognize improvement, not just performance.

- Continually provide educational opportunities, such as learning more about a particular procedure or treatment, as it helps those who aren’t as involved such as front desk or back office employees feel included. Plus, they can speak to patients with greater authority. Bonus points if you can make this fun by turning it into a game like Jeopardy.

- Offer cross training opportunities internally and externally by allowing them to participate within the industry such as at tradeshows or with groups/forums.

- When introducing a new employee to a current employee, mention something great he or she does on the job.

Be Flexible

- Be as flexible as possible with work arrangements to avoid burnout and because it is always easier to retain an employee than recruit a new one.

Even with employee recognition and work/life balance accommodations in place, employers must realize that many team members will not stay forever. And not every resignation is a bad one, especially if you recognize that employees need to move upwards and onwards in their careers (and occasionally that means a new place of work).

Next month, we'll look at ways that Alphaeon Credit can automate and simplify your patient financing process, reducing your team’s workload and making their days a little easier.

Patient Stories from 2021

Before the holidays, we asked Alphaeon Credit patients to share their stories with us. We received an overwhelming response and a common theme among responses is that the procedures or treatments you provided were life-changing. (A huge thank you from them and us for all that you do!)

Before the holidays, we asked Alphaeon Credit patients to share their stories with us. We received an overwhelming response and a common theme among responses is that the procedures or treatments you provided were life-changing. (A huge thank you from them and us for all that you do!)

So very thankful this year for the life-changing experience of perfect vision!

My breast reduction was absolutely life-changing.

I am living my life pain free and am able to smile again!

Many patients also commented on how financing impacted their decision to move forward with a procedure or treatment and we observed some trends that are worth mentioning to make sure you are getting the most out of your patient financing.

1) Many patients don’t know financing is available before their initial appointment or consult

Many patients waited years for their procedure or treatment because they thought they couldn’t afford it and were unaware they could pay over time.

I had to keep changing my dates months out for the surgery I wanted so bad [due to cost]! I turned to Alphaeon and they made me feel like it was Christmas, as I got my procedure done the very next week.

This patient delayed care months, if not years, because they were unaware of financing options. Most patients research procedures and treatments before calling a practice to set up an initial consult or appointment. That is why we encourage all practices to incorporate an affordability with financing message into any external marketing such as advertisements, digital/search ads, direct mail, and websites.

Here's another patient who spent much of his visit worried about cost as he was unaware of financing options:

At 61, my eyes were getting bad from all the computer work I do and when I went for my eye exam, he said I had cataracts in both eyes. Oh good grief, how was I gonna pay for this? The financial person at the eye doctors office assured me that Alphaeon was the only way to go. What an easy process!!! No worries on paying a big bill up front. Thank u thank u.

This mother desperately wanted a cosmetic procedure, but didn’t think it was possible.

Being a single mom at 16 was not easy. The first thing you do is put your child first and almost forget about yourself…By the time you reach your 40s and your child has their own life…the only one left for me is me. Looking back, what did I do for me? I took care of everyone, and it is time to take care of me. I deserve it. I worked so hard and it is time to reward myself. Oops, I used my hard-working money for everyone else. Now what??? Do I wait on living life and being happy for another 10 yrs until I save the money?...My doctor told me about Alphaeon…I could not believe it!! I can start my new life and be happy NOW, I don't have to wait for 10 yrs...I took care of everyone and everyone moved on. Now I have Alphaeon taking care of me now…Thank you Alphaeon for being there for me.

2) Many patients can’t or won’t move forward without financing

This was a sentiment we heard repeatedly. Many patients are realistically never going to save up the money for a procedure, but will schedule if affordable financing is an option.

Without Alphaeon Credit, I would not have been able to afford a life-changing cosmetic procedure. It was truly the best decision I have ever made and my life has been transformed for the better. I have benefitted both personally and professionally and my confidence has increased dramatically.

If it weren't for this credit option, I'd still be in glasses! Hats off to the company for giving us this finance option for LASIK. Life-changing for sure.

I am so thankful for Alphaeon. I was able to use my card to finance an expensive dental procedure that I wouldn't have been able to afford outright.

By offering and promoting Alphaeon Credit, these are the patients you are helping. They may never tell you that cost is the prohibitive factor in receiving treatment. However, if you make financing options convenient and accessible, they will take advantage of them and move forward with care.

3) Recommending patients to Pre-Qualify before visiting your practice can save you (and your team) time and allow you to schedule procedures or treatments faster

If your office, like so many others, is experiencing staff shortages, it might be time to guide patients toward pre-qualifying for financing on their own. Many patients commented how easy it was to apply for Alphaeon Credit at home and felt confident walking in to see their doctor knowing how they were going to pay.

It was a fast, simple, easy application - and an instant credit decision. Thankful for Alphaeon. I was finally able to get the surgery I have been wanting for so long and with low monthly payments.

The doctor told me he could make it possible. He showed me the different plans and what one that would be best for me. I went home, thought about it, and prayed about it. Then I applied and to my surprise, I was approved. I would like to say thank you for making it possible for me to have the credit for the surgery, it has been a very amazing experience for me.

If you are sending appointment reminders or information prior to their initial visit via text or email, consider incorporating a link to the pre-qualification page.

“Did you know we offer financing for any charges over $250? Interested in pre-qualifying prior to your visit? Visit https://goalphaeon.com/prequalify-me. There is no impact to your credit*. It’s quick, easy, and secure with instant results, including your credit limit.”

*Not a final credit decision

For patients who want a procedure or treatment and can't afford it, financing means hope. And for those who can afford care, financing means flexibility which can be the difference between someone saying “yes” or “I’ll think about it”. By educating prior to appointments you can address both concerns.

Our mission at Alphaeon Credit is to help you help more patients. Thank you for continuing to offer Alphaeon Credit and allowing us to play a very small role in these “life-changing” journeys.

Credit Card or Loan? What's Best for Your Practice

Revolving Line of Credit vs. Installment LoanWhat’s the best choice for your practice?

To begin, what’s the difference?

While revolving lines of credit and installment loans provide patients with a way to pay for procedures, treatments, and services over time, there are differences that may convince you to offer one over the other.

A revolving line, like Alphaeon Credit, offers patients a line of credit that can be used repeatedly at any location that accepts that particular type of credit. This line of credit has a credit limit and the patient can repeatedly spend up to their individual credit limit. The limit is based upon the patient's personal credit history, debt to income ratios, and the bank’s willingness to lend. Purchases reduce the patient’s available credit, and as the patient makes payments to pay off their balance, the credit limit increases, making funds available for purchases.

Comparatively, an installment loan is for a one-time use where consumers borrow a set amount of money and pay it back over time, often with fixed monthly payments. Like revolving lines of credit, the approval for the loan is based upon the patient's personal credit history, debt to income ratios, and the bank’s willingness to lend.

What’s best for my practice?

Revolving Line of Credit Benefits

Patients May Return More Often and Spend More: There is a reason retailers offer a “private label card”, a card branded with the store’s name. Providing a dedicated line of credit increases the customer’s lifetime value. Customers with the card return more often and spend more than those without the card.

If you want patients or their family members to return to your practice for additional procedures, treatments, or services, a revolving line of credit makes that process easy as the patient doesn’t need to reapply every time they make a purchase. They simply use their revolving line of credit. Cost concerns are reduced because the patient knows they can split the payments up over time often with deferred interest. As they pay the balance, more funds are made available for subsequent purchases.

In addition, the companies offering revolving lines of credit often market your practice to existing cardholders encouraging them to return and reuse their card. The only caveat is there are two many places where the card can be used, you may find that when your patient returns, they have used their available line of credit somewhere else. Alphaeon Credit is only offered in 4 medical markets, so this is less of a concern.

Patients Get Approved and Schedule Faster: Installment loans tend to ask for more information to complete an application or require more paperwork. No one will pretend that patients seek your practice out solely based upon your acceptance of that credit card, but patients may also schedule faster because the cost barrier has already been removed and deferred interest options are available.

Patients Appreciate Deferred Interest: Understandably, the most popular plans for any elective medical procedures or treatment not covered by insurance is a deferred interest plan. For many patients, this can be a smart move, as these plans allow them to pay over time with no interest as long as they pay off the balance in full by the end of the promotional period.

You may have heard that millennials don’t want another credit card. However, that assessment isn’t exactly accurate. A better statement would be that Millenials want credit cards that meet their needs without a lot of bells and whistles including not charging an annual fee and offering no or low interest options1. Healthcare revolving lines of credit meet these requirements.

Installment Loan Benefits

Patients Can Finance Procedures over $32,000: Installment loan banks finance pricier procedures, specifically, in excess of $32,000. This is because their risk is reduced for a one-time loan and interest is usually charged.

Patients May Have Access to Longer Terms: Most revolving lines of credit offer up to 60 months of payments with interest, however installment loan providers sometimes offer up to 84 months of payments with interest. This equates to a lower monthly payment for patients, however, patients may be less likely to return when they are still paying off their last procedure or treatment for seven years.

Patients Don’t “Roll Out” of their Promotion: Practices offering revolving lines of credit usually offer deferred interest plans. All patients are attracted to these special financing offers, including those who could pay in cash. As mentioned earlier, it’s a smart move and an extra incentive to schedule today. However, these deferred interest plans require a patient to pay off the entire purchase amount within a specified time period to avoid paying retroactive interest. While the vast majority of patients pay within their promotional period and greatly appreciate the ability to finance over time with no interest, some miss their deadline and incur interest fees as a result. The best way to overcome this hurdle, if you offer revolving lines of credit, is to educate your patients on the importance of paying off the entire balance before their promotional period expires.

Conclusion

When evaluating your patient financing options, it makes sense to look at the types of procedures or treatments you offer. If the majority of your patients are spending $30,000, or $40,000 and need longer terms, installment loans make sense. However, if the majority of your patients are spending less and they appreciate deferred interest, then revolving lines of credit are the best choice.

1https://thefinancialbrand.com/113048/millennials-credit-cards-rewards-points-myth/

Is TikTok right for your practice?

Do you have any idea how many people are on TikTok worldwide each month? If you guessed over a billion, you'd be in the ballpark. TikTok is not only the most downloaded app in 2021 but one of the fastest-growing apps in history. In comparison, Facebook and Instagram took twice as long to reach the same billion-user milestone. Some might say it is a fad, but what if it isn't? If you aren't promoting your practice on TikTok, should you be? And how?

Do you have any idea how many people are on TikTok worldwide each month? If you guessed over a billion, you'd be in the ballpark. TikTok is not only the most downloaded app in 2021 but one of the fastest-growing apps in history. In comparison, Facebook and Instagram took twice as long to reach the same billion-user milestone. Some might say it is a fad, but what if it isn't? If you aren't promoting your practice on TikTok, should you be? And how?

Many classify TikTok as a social media platform, but that definition can be misleading. A social media platform often requires people to "like" or "follow" you to see your content. TikTok's mission statement isn't about connecting people. It defines its mission this way: "To capture and present the world's creativity, knowledge, and precious life moments.... TikTok enables everyone to be a creator and encourages users to share their passion and creative expression through their videos." At its core, TikTok is an entertainment platform full of content creators. It isn't necessarily based on who you know but what you like.

@jera.bean 3 Reasons Why TikTok is a MARKETING MACHINE ⚡️ #tiktokforbusiness #tiktokforbrands #tiktoktips #learnontiktok #tiktokpartner

♬ original sound - Jera Foster-Fell

If you're new to TikTok, start here. If not, skip ahead!

If you're new to TikTok, here is how it works. When you initially open an account, TikTok will ask about your interests. The TikTok algorithm will then curate content and show videos it believes you'll enjoy. As you like and share videos or start following other users, the algorithm adapts and improves its curation abilities. The advantage of TikTok from a marketing perspective is that it is not your responsibility to earn followers. Considering only 74% of users are following specific brands today, the likelihood of you earning followers based upon your brand name alone is relatively low. If you produce engaging content (based upon likes, shares, and comments), TikTok will do the work for you and start showing your video to more users, organically generating followers. This can rapidly increase your base. For that reason, many successful creators have millions of followers.

But isn't it just for kids?

While many people still think of TikTok as a young person's platform, two-thirds of TikTok's current users are over the age of 19, meaning most of them make their own medical and purchasing decisions. TikTok users also tend to be in a higher income bracket, with 53% living in households that make over 75k a year.

OK, so my patients may be on TikTok, but should I participate as a practice? Will it hurt my brand?

From a marketing perspective, the consensus among experts is that you should do it, and do it now because being first to market can give you quite an advantage later on.

"It's almost imperative for brands to be on it because now is the time to capture that organic growth," says Aliza Licht, founder and president of consultancy firm Leave Your Mark. "TikTok is ripe for the taking."

Neil Patel, co-founder of NP Digital, says, "The low business competition presents a massive opportunity because you can reach many people at a relatively low cost."

TikTok can also maximize your reach, especially for smaller practices with limited budgets. Bradford Manning, who promotes his clothing, Two Blind Brothers (@twoblindbrothers), on the platform, comments, "I don't think the largest brands will see the same type of outperformance that a smaller brand can find." Unlike Facebook, Instagram, and Twitter, where you are actively competing with the Walmarts, Amazons, and Apples of the world, TikTok favors smaller "breakout" creators, and your practice could easily be the next one to go viral as you are on the same playing field as the largest brands in the world.

Who is using it now?

If you search for any elective procedure, treatment, or service on TikTok, you will quickly find others who have jumped on the TikTok bandwagon. One such doctor is Dr. Daniel Barrett, whom the practice has dubbed "The Natural Plastic Surgeon" for his scar management protocols and closure techniques. However, his medical expertise is only part of the equation of the practice's success. Barrett Plastic Surgery purposefully uses social media to inform, educate, and promote procedures and treatments to potential patients.

"When it really started to ramp up was March or April last year during the lockdowns. I like to keep busy! I started making a few TikToks, and it took off from there," says Dr. Daniel Barrett of Barrett Plastic Surgery.

Today, Dr. Barrett has 1.7 million followers on TikTok, 18 times their number of Instagram followers, and an incredible 458 times their number of Twitter and Facebook followers combined!

Dr. Barrett's TikToks regularly surpass multiple millions of views and are fun and educational. Videos of Dr. Barrett performing surgery also receive high view counts:

@barrettplasticsurgery Reply to @bumbandy Wtf just happened behind me? 😂💀 #plasticsurgery #implants #notaperfectperson #wintermagic #plantparent #fyp

♬ original sound - Dr Daniel Barrett

His videos are often evocative to people not used to seeing what surgery looks like. While this experience can make viewers squeamish, it can also destigmatize surgery and reduce fear as patients are more educated about the procedures or treatments they are considering. This video shows a liposuction procedure. Warning: If you're squeamish, you may want to skip

@barrettplasticsurgery I N S A N E Results at the end! 🤯 #transformation #sosatisfying #plasticsurgery #tummytuck #fyp #foryou

♬ original sound - Dr Daniel Barrett

Dr. Barrett's team posts multiple times nearly every day. Many videos are quick tidbits, including his ongoing series "Plastic Surgery Secrets," with over 100 episodes.

@barrettplasticsurgery What do you guys think about #gwenstefani 🧐 #greenscreenvideo #botox #rhinoplasty #nodoubt #plasticsurgery #plasticsurgerysecrets

♬ original sound - Dr Daniel Barrett

Many TikTok accounts swear by this method, as the platform rewards users who generate a lot of quickly produced content. The algorithm will pick up some videos, but many won't gain traction; it can be difficult to predict or tell why afterward.

@barrettplasticsurgery Hmm, Plastic surgery or weight gain? 🤔😱 #earthday #zacefron #filler #weightgain #neontwin #springoutfit #oscars #promszn #vaccinatedfor #songfacts

♬ ghost town voice memo (full version out now) - chloe george

"TikTok is this enigma," asserts Dr. Barret. "There are definitely some things we know to do that help the algorithm pick us up. We know there are some things that are our niche or the wider audience will find interesting, but I would love to meet the person who has TikTok figured out!"

Dr. Barrett's efforts on TikTok have paid off for him and his team. Not only are users on the platform more aware of him (and thinking more about plastic surgery generally), but media outlets often start citing him as an expert in the field. His efforts on social media have increased his popularity both in the media and with potential patients.

Crossposting

Creating video for a single platform can feel daunting. But if your practice has previously invested in building your Facebook and Instagram audiences, there's no reason why you shouldn't take advantage of those.

Crossposting (creating content and posting it on multiple platforms) is a perfectly acceptable way of making sure your potential patients hear what you have to say. You can easily create the videos on a smartphone, then save and post them to multiple social media networks.

Dr. Barrett told us that they still see new patients who found their practice through TikTok: "It features in a patient's research process, in the same way, a patient may look at Facebook or Instagram, for example. It's more light-hearted….Even now, I’ll meet with patients who found us on their 'For You' Page."

Is it safe?

There have been valid concerns regarding TikTok's data mining and sharing tactics. However, security experts point out that, aside from being a Chinese company, their methods are no more intrusive than any other social media platform.

"Of all the serious cyber risks facing the average consumer, TikTok isn't on the top of the list. Most Americans ought to be way more concerned about credit card fraud and password protection than TikTok," Monica Eaton-Cardone, co-founder and chief operating officer of Chargebacks911, said.

Chester Wisniewski, principal research scientist at Sophos, agreed: "TikTok doesn't pose any more risk to a user than any other social media sharing application. That isn't to say that there isn't risk, but it's not really different from Facebook, Twitter, or Instagram."

What should I post about?

In a recent article in the Journal of Plastic and Reconstructive Surgery, "Is TikTok the New Instagram? Analysis of Plastic Surgeons on Social Media," the researchers sorted common posts on Instagram and TikTok into the following categories:

Patient or surgery related

Personal post

Self-promotional

Product advertisement

Educational

Other

The "other" category consisted of viral content such as discussions of celebrities, funny and engaging posts, and inspirational content.

If you are just starting, you may want to create a video in each category and see what hits. Trial and error is highly recommended as you find your niche on TikTok. Even after you figure out what works, you may become frustrated as videos that you were sure would be well-liked don't take off, and those that were the easiest to make become viral sensations.

In the other category, Dr. Ben Winters, an orthodontist in Plano, Texas who is known as “The Bentist”, gained 8 million followers on the platform by showing off his dance moves.

@thebentist Sometimes I wonder why I went to school for 15 years and paid 500,000 in student loans 😂🙌🏻 almost to 9 MIL! 🎉

♬ Into The Thick Of It! - The Backyardigans

@doctorgao Are you using the right amount of toothpaste? #dentist #dental #dentistry #tiktokguru #youngcreators #learnontiktok #edutok #teeth #foryou

♬ Mad at Disney - salem ilese

TikTok has also been the source of many misconceptions and myths about oral health, which is why it's important for authoritative voices to set the record straight. For example, Magic Erasers became an at-home method of teeth whitening thanks to users on the site.

It took dentists on the platform to remind everyone that while it might technically work, it's certainly ill-advised, and there are much better ways to whiten teeth. Once again, the Bentist was there to correct the misinformation:

@thebentist Did she really just say she uses a magic eraser to clean her teeth… 😳 please don’t make this a trend 😂 #learnontiktok #tiktokpartner #teeth

♬ original sound - The Bentist

Don't forget to get others to post for you too, if possible.

Considering that 81% of consumers trust a message that comes from a friend more than a message that comes from a business and that more than half of all active TikTokers post content, you should consider encouraging your patients to post too.

They can post about their procedures and treatments, before, during, and afterward, if they are willing and it is appropriate. With TikTok, if the content is engaging, it may spread beyond the patient's immediate social circle. In addition, when patients post about their procedures and treatments, you may be raising awareness beyond your geographic reach and helping your peers in other markets.

@sarah.calvillo Documenting my experience before I become ungrateful #comedy #lasik #lasikeyesurgery #millennial #wfhlife

♬ Blue Blood - Heinz Kiessling & Various Artists

@thebeccamurray Reply to @lockstockandspoonies suffice to say, i’m obsessed #lasik #lasikeyesurgery #scienceismagic

♬ SUNNY DAY - Matteo Rossanese

Once they post, be sure to Duet or Stitch their video to generate unique content for your own followers. (Duet allows you to have your video playing side by side with someone else's, and Stitch lets you incorporate up to five seconds of someone else's video into your own.)

I might try it. What else do I need to know?

Tik Tok Best Practices

- Be Yourself. It may sound cliché, but TikTok creators have found the best performing videos are those in which they are authentic. TikTok allows your patients to get to know you and your practice better. This is an opportunity to showcase the personalities within your practice.

- Share What You Know. Do you have "insider" information for the average person? Share it. If you see something is trending on TikTok that you know is untrue or needs additional clarification, Duet or Stitch it.

- Be Prepared to Reply. You can become "TikTok Famous" literally overnight, and if you do, you may have thousands of comments. By replying to comments, you can earn more followers. It can also be a great source of inspiration for your next TikTok, as you can reply to a comment or question with a brand new video. Often questions about cost will come up, so be prepared to reply with a link to Alphaeon Credit's pre-qual page for those interested in finding out if they are likely to be approved without impacting their credit.

@tiktokforbusiness Reply to @teejayhughes Looking for ways to increase engagement? Try replying to comments with video 🎥#learnontiktok #tiktoktips #marketingtips

♬ FEEL THE GROOVE - Queens Road, Fabian Graetz - Don't Worry about Production. Leave the filters for Instagram, unless you are having fun showing how crazy the filters are on TikTok. Once you get started on TikTok, you'll find overproduced videos tend to get fewer likes than those with minimal production. TikTok users, who spend an average of almost an hour on the app daily, have trained themselves to ascertain in seconds if they want to watch more. A slick video can scream "sales pitch" and cause users to swipe up instantly. A smartphone with a decent camera is all you need to get started.

If you want to get fancy, you can try to create some videos with high-quality transitions as users will watch your video repeatedly to try to figure out: "How did they do that?" Also, consider using the auto caption feature. It makes your video more accessible, and videos with captions tend to have longer view times, which can help increase the likelihood that your video will be shown on the platform. - Participate in Trends. Over half of all content on TikTok is trend videos. A trend is simply when multiple TikTok users take a video and recreate it putting their spin on it. It might be a dance, song, or just a statement, like this one where you tell a cringe-worthy story:

@nikkithechameleon Leonard was a bit confused #wakingupinthemorning #fyp #trending

♬ original sound - Amir Yass

Participating in trends and challenges is a great way to reach the "For You" page and develop new content when you aren't feeling creative. If you are active on TikTok, you'll quickly spot trends as you'll see several similar videos. If you aren't as active, head over to the TikTok discover page to find trending videos.

Is TikTok right for you?

It may be as long as patients' privacy is maintained and you aren't running afoul of any regulations with third parties, like a hospital system, which may soon have rules regarding TikTok videos.

We strongly urge that practices get written permission from patients before sharing anything on social media. Barrett Plastic Surgery explains how they manage: "We're very clear with our patients on what level they would like us to tell their story, and our team is very sensitive to that...Some patients are very happy to tell their whole journey, including interviews; we work closely with them, based on their comfort levels."

Many state and national associations offer useful guidelines for social media use to their associated practices. Jessica Lauria, Communications and Media Coordinator for the Florida Dental Association, notes, "You don't have to join every social media network to reach your audience. It's important to pick the social media platforms that best fit your organization and post consistent, compelling content that makes sense for your audiences and for that platform.

"Industry professional associations, like the Florida Dental Association, are great resources for social media guidelines, best practices, and engaging content that you can share on your social media channels."

If you go viral, you will likely be invited by TikTok to become an official creator and will be paid—albeit a very small amount—for future videos. If this happens, you will have access to analytics showing your reach.

Until that time, you may want to upgrade to a free business account.

“With a business account, you have access to real-time metrics on your content performance so you can understand what’s working well and make the most of it. You’ll get insights into your follower base so you can better understand who’s watching the content you create. And you’ll also be able to add basic information about your business.”

Money Talks

Surprisingly, most medical practices fail to offer financing nearly as often and as proactively as these big box stores, even when the purchase amount is significantly higher.

How Your View of Financing Could be Hurting (or Helping) Your Practice

When was the last time someone asked you to sign up for a credit card? Last week, yesterday, or maybe even today? As consumers, we're asked about financing at nearly every store we shop at, from Home Depot to Home Goods and from Best Buy to Banana Republic. Everyone asks, "Do you have our credit card? Have you joined our loyalty program? You can save 20% by financing today!" No matter if it is a $20 purchase or $2000, the refrain is the same.

Surprisingly, most medical practices fail to offer financing nearly as often and as proactively as these big box stores, even when the purchase amount is significantly higher. When asked "why," coordinators, counselors, and schedulers often share:

"I don't feel comfortable talking about money; it's just too salesy in a medical setting."

"Our patients are wealthy (or we practice in an affluent area), and they don't need financing."

"We tell them about financing. It is on our website, in our patient information packets, and we have brochures in the waiting rooms. If they're interested, they let us know."

At Alphaeon Credit, we've heard these responses hundreds, if not thousands of times, and we know practices that think this way tend to experience slower growth year over year compared to their peers in the same market. If you're interested in growing your practice and have ever found yourself repeating the statements above, please read on to maximize your growth potential!

"I don't feel comfortable talking about money; it's too salesy."

Remind yourself that you offer procedures and treatments that benefit the patient and are life-changing in many cases. By talking about finances, you're only helping patients get what they want and what you recommend. Talking about cost and the patient's financial situation is a positive; it is simply helping them.

If you're not mentioning the total cost until the end of the conversation, consider talking about it earlier and the availability of financing options. Patients know that procedures and treatments come with a price tag and start an internal dialogue regarding their finances from the start. They wonder, "How much is it? or "How am I going to pay for it?" As they have these thoughts, they tune out and may miss crucial information. How many times has a patient forgotten something you said? There’s a good chance they may have been thinking about the price instead of listening. By addressing cost early, you can ensure your patients can focus on what you are saying.

One of the best ways to get comfortable talking about money is by writing a script. You can adjust depending on the situation, but a well-written script provides the framework to help you discuss costs confidently. You may also incorporate elements of your script into the paperwork you share with patients so that you can read off your script without the patient even noticing. After writing your script, rehearse with some team members. Practice makes better! You can also email teamcredit@alphaeon.com to rehearse with a Business Development Manager or for help drafting your script.

"Our patients are wealthy (or we practice in an affluent area), and they don't need financing."

Over a decade ago, a plastic surgeon in Beverly Hills made a similar statement to an Alphaeon Credit team member. He advised the doctor, "Humor me. Just put out some brochures and see what happens". The doctor agreed and two months later called to share his surprise at finding out several wealthy patients were very interested in financing and eagerly applied and used their cards to pay for their procedures. We’ve had the same conversation and seen similar results hundreds of times since then.

When it comes to financing, many presume that financing is only for those with no other way to pay. In fact, financing, especially no-interest plans, is incredibly attractive to those who have cash in the bank. We’ve even had a patient who earns $900,000 a year apply for Alphaeon Credit! With no interest plans, the patient can borrow money at 0% while their money remains invested, earning interest. Utilizing no interest plans can be a wise financial move as long as the patient pays off the balance before their promotional plan period expires. Plus, making a large purchase, regardless of an individual's income, can create anxiety - financially and/or emotionally. Breaking down a large expenditure into smaller monthly payments can reduce this stress as the figures are more manageable.

"We tell them about financing. It is on our website, and we have brochures in the waiting rooms. If they are interested, they'll let us know."

When a patient is considering a procedure or treatment, often there is a tremendous amount of information to absorb. Most websites don't place financing in a prominent position or make it easy to find. Usually, financing is under "patient resources" or "insurance," so while financing pages tend to rank high in viewership, there is a good chance your patient didn't see it. And if the patient is in the waiting room, they are likely looking at their phone and not at the brochures scattered throughout. That is why we recommend always mentioning financing verbally, at multiple steps throughout the patient's journey - from the initial phone call, to consultations, to scheduling. The phrasing is simple, "Are you familiar with how financing works?" or "Did you know we offer financing?"

It is also helpful to personalize the patient's financing message by using the Alphaeon Credit payment calculator and estimate how much the exact procedure or treatment will cost with financing. If you don't know the precise amount, offer a range of monthly payment amounts. "Usually, these procedures cost between $70-125 a month if you choose to finance it, or $3,000-$5,000 if you want to pay in full".

Another way to educate patients about financing is to send them a pre-qualification link before their consultation via email or text. Plus, patients who have financing secured usually show up for their appointments and often schedule on the same day.

In conclusion, if you ever caught yourself in one of these mindsets, we encourage you to consider an alternate view. We are confident that by doing so, you will likely find more patients will be able to move forward, and they will be happier because you helped make it happen!

How to Avoid and, if Necessary, Win Disputes

Payment disputes happen. You work hard to make sure every patient is happy with their outcomes, but sometimes certain patients still aren't satisfied. And when that happens, they occasionally refuse to pay for their treatment and procedures.

We sat down with Tina Jones, who handles the dispute process for ALPHAEON CREDIT to discuss how your practice can avoid disputes and be ready when they do occur.

A conversation with Tina Jones, Concierge Dispute Manager for ALPHAEON CREDIT

Payment disputes happen. You work hard to make sure every patient is happy with their outcomes, but sometimes certain patients still aren't satisfied. And when that happens, they occasionally refuse to pay for their treatment and procedures.

We sat down with Tina Jones, who handles the dispute process for ALPHAEON CREDIT to discuss how your practice can avoid disputes and be ready when they do occur.

Q: So why might a practice receive a dispute, and how does a patient submit one?